THE ULTIMATE SAAS LINK BUILDING GUIDE

Table of Contents

Ayush Bagwari

Hi, I'm the CEO & Founder of Outreach Empress. I help brands and SEO agencies get better organic rankings with our link building services.

A SaaS founder called me last week, frustrated.

“We have 80 backlinks. Our competitor has 60.

So why are they ranking above us for everything?”

I pulled both backlink profiles.

His 80 links:

Scattered across random blogs, press release sites, and low-traffic directories.

Average DR: 35.

Topical relevance: zero.

His competitor’s 60 links:

All from SaaS review sites, marketing blogs, and project management resources.

Average DR: 38.

Topical relevance: incredibly high.

The competitor was crushing him — with fewer links.

This is what most SaaS founders get wrong about Saas link building.

They think:

“More links = better rankings.”

That mindset is exactly why SaaS link building fails for so many software companies

Reality:

“More relevant links from the right places = better rankings.”

I’ve been managing SaaS link building campaigns since 2020. Over five years and 100+ campaigns, I’ve learned that SaaS link building is fundamentally different from other industries.

We have been providing SaaS link building services from last 5 years and understood it well that the strategies that work for e-commerce don’t work for B2B SaaS.

The links that help consumer brands hurt software companies.

The tactics that worked in 2020 can get you penalized in 2025.

This guide shares what actually works.

No theory.

No recycled SEO advice from 2015.

Just what we’ve seen move the needle for SaaS companies — from pre-revenue startups to $10M ARR players.

If you’re trying to figure out how to rank your SaaS tool, this will show you the path.

Why SaaS Link Building Is Fundamentally Different

Before we talk about strategies, you need to understand why SaaS link building is its own beast.

Most link-building advice online is written for e-commerce or local businesses. It doesn’t apply to SaaS.

Your Audience Is Professionally Skeptical

When we started, we tried applying standard link-building tactics to B2B SaaS clients. Response rates were terrible.

Why? Because your buyers aren’t impulse shoppers.

They’re:

CTOs researching solutions for three months

Product managers comparing 12 alternatives

Marketing directors who’ve been burned before

Founders spending $50K per year on your category

They can spot sponsored content instantly. They actually read articles end-to-end. They cross-reference claims across multiple sources.

This means generic “Top 10 Project Management Tools” posts don’t work unless they’re genuinely useful and unbiased.

From our campaigns:

Generic tool roundups: 3% acceptance rate, minimal traffic

Deep comparison articles with real insights: 18% acceptance rate, consistent qualified traffic

The difference? Your audience demands substance.

Relevance Trumps Authority Every Single Time

Here’s a pattern we’ve seen in every campaign:

A DR 65 link from a major tech news site talking about consumer gadgets

→ Drives ~5 visitors per month, zero signups

A DR 32 link from a SaaS-specific review site in your category

→ Drives ~40 visitors per month, 2–3 signups

Google’s algorithm understands topical authority now. This is especially true in SaaS link building, where relevance consistently outweighs raw domain authority. A link from a site that consistently talks about your industry carries more weight than a link from a random high-authority site.

We had a marketing automation client with links from:

TechCrunch (DR 93): Article about AI trends

MarketingProfs (DR 47): Article about marketing automation tools

The MarketingProfs link drove 8× more ranking improvement.

Why?

Because Google knows MarketingProfs is an authority on marketing tools. TechCrunch covers everything tech.

Context matters more than raw authority.

Link Velocity Can Destroy Your SaaS Link Building Campaign (Even When Links Are Good)

In 2022, we took on a client who had worked with another agency for two months.

They acquired 73 backlinks in six weeks.

All real sites.

All relevant.

All high quality.

Their rankings dropped 25 positions across the board.

Why?

Google saw 73 new backlinks in six weeks on a site that historically gained 3–5 links per month. The algorithm flagged it as manipulation.

We had to slow everything down, disavow nothing (the links were clean), and wait four months for the penalty to lift naturally.

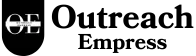

From tracking 100+ campaigns, here’s what we’ve learned:

Safe Link Velocity by Domain Authority

DR 0–20: 3–8 new links per month

DR 20–40: 8–20 new links per month

DR 40–60: 20–40 new links per month

DR 60+: 40–80 new links per month

Exceed these numbers by 2×, and you’re playing with fire.

Slow and steady wins.

Fast and aggressive gets you penalized.

You Need Link-Worthy Assets (Your Homepage Isn’t Enough)

You Need Link-Worthy Assets for Successful SaaS Link Building (Your Homepage Isn’t Enough)

Early in our agency journey, a SaaS founder asked us to get links to his homepage.

“Just tell people about our product. They’ll want to link to it.”

We sent 200 outreach emails.

We got 4 links.

A 2% acceptance rate.

Why?

Because nobody links to a product homepage unless it’s already famous. In SaaS link building, assets earn links — products rarely do.

People link to:

Comprehensive comparison pages

Original research and data

Free tools or calculators

In-depth guides that solve specific problems

Case studies with real numbers

From our campaigns:

Clients with strong link-worthy assets: 16% average acceptance rate

Clients with just a basic site: 4% average acceptance rate

You can’t skip the foundation.

Build something worth linking to first.

SaaS Buyers Research Across Multiple Touchpoints

Unlike consumer purchases, SaaS buying cycles involve:

3–6 decision-makers

2–4 months of research

Reading 10+ articles before contacting you

Checking 5–8 competitor alternatives

This means links need to be part of a broader content ecosystem.

One link on one site won’t convert anyone.

But 15 links across review sites, comparison articles, and how-to guides create omnipresence.

When someone researches “[your category] software,” they should see you on page one for:

Best [category] software

[Competitor] vs [You]

How to choose a [category] tool

[Category] software for [use case]

That’s when conversions happen.

When you’re everywhere in their research journey.

Link building for SaaS isn’t about one big win. SaaS link building isn’t about one big win.

It’s about systematic coverage across the entire buying journey.

The 5 SaaS Link Building Strategies That Actually Work

Over five years, we’ve tested every SaaS link building tactic out there.

Over five years, we’ve tested every SaaS link building tactic out there.

Most don’t work for SaaS. These five do.

Here’s what works, why it works for link building for SaaS companies , and exactly how to execute.

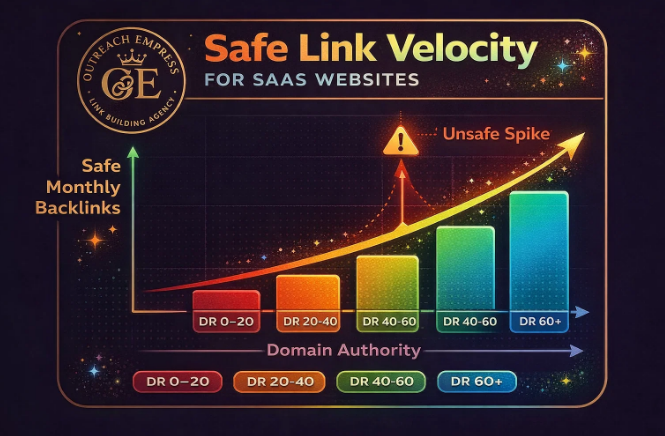

Strategy #1: Authority Cluster Targeting

(The Most Important SaaS backlink Strategy)

It’s also the strategy that drives the biggest gains in SaaS link building campaigns.. It’s also the one that drives the most ranking improvement.

What It Is

Authority clusters are groups of sites in your niche that:

Cover the same topics

Link to each other naturally

Are recognized by Google as topically connected

Include all the “big names” in your category

Example for project management SaaS:

Capterra, G2, Software Advice (review platforms)

Asana’s blog, Monday.com’s resources, ClickUp’s guides

Productivity blogs: Zapier, Notion, Todoist

Business publications covering PM: Fast Company, Inc, HBR

These sites form a cluster.

They reference each other.

They cite each other.

Google sees them as authoritative for “project management tools.”

Why This Works

When 3–4 sites in a cluster link to you, Google interprets it as:

“This tool is part of the conversation in this space.”

When your links are scattered across random sites with no connection, Google sees them as isolated votes — not a collective signal.

We tested this directly in Q2 2024:

Campaign A: 30 links from sites in a target authority cluster

Campaign B: 30 links, same average DR, but scattered across random sites

Everything else identical (anchor text, velocity, content)

Results after 90 days:

Campaign A: +14 positions (average across target keywords)

Campaign B: +5 positions (average)

Campaign A saw 2.8× better results from the exact same number of links.

The cluster strategy is that powerful.

How We Execute This

Step 1: Map Your Authority Cluster (Week 1)

Use Ahrefs or SEMrush:

Enter your top 3 competitors

Go to the Backlinks report

Export all linking domains

Filter for DR 25+, dofollow links only

Find domains that link to 2+ competitors

Those overlapping domains = your authority cluster.

For a project management SaaS, we typically find 40–60 cluster sites.

Step 2: Prioritize by Influence (Week 1)

Not all cluster members are equal. Rank them:

Tier 1 (Must-Have): Sites all 3+ competitors have

→ These are table stakes. You’re invisible without them.Tier 2 (Important): Sites 2 competitors have

→ These close significant gaps.Tier 3 (Nice-to-Have): Sites 1 competitor has

→ These provide advantage if you get them.

Focus 80% of your effort on Tier 1.

Step 3: Systematic Outreach (Weeks 2–8)

Don’t blast everyone at once. If you get rejected by the whole cluster early, you’ve burned the opportunity.

Our approach:

Weeks 2–3: Target 5 “easier” Tier 1 sites (directories, resource pages)

Weeks 4–5: Target 5 “medium” Tier 1 sites (review platforms)

Weeks 6–8: Target 5 “harder” Tier 1 sites (competitor blogs, premium publications)

As you get placements, mention them in later outreach:

“We were recently featured on Capterra and G2.

Thought we might be a fit for your [category] roundup as well.”

Social proof within the cluster accelerates acceptance.

Step 4: Monitor Cluster Expansion

Clusters aren’t static. New sites emerge. Old ones lose relevance.

Every quarter, re-run competitor analysis to identify:

New sites linking to competitors (add to your target list)

Cluster members linking to new sites (potential targets)

Changing patterns (new platforms gaining influence)

Stay current with the cluster, or you’ll fall behind.

Real Example

Client: Time-tracking SaaS (DR 28)

Cluster: 47 sites (review platforms, productivity blogs, remote work resources)

Campaign:

Duration: 6 months

Focus: Cluster placements only

Links acquired: 31 (all from cluster members)

Average DR: 34

Results:

“Time tracking software”: Position 28 → Position 7

“Employee time tracking”: Position 45 → Position 11

19 other related keywords: new page 1 rankings

Organic traffic: 840/month → 3,200/month

Trial signups from organic: 3/month → 28/month

The key: Every single link came from a site in the authority cluster.

We turned down 15 higher-DR link opportunities because they weren’t in the cluster.

Those would have diluted focus.

Concentrated cluster coverage beats scattered high-DR links every time.

When This Strategy Works Best

✅ You have clear competitors with established backlink profiles

✅ Your category has a defined set of review/resource sites

✅ You’re willing to play the long game (6+ months)

When This Doesn’t Work

❌ You’re in a brand-new category (no cluster exists yet)

❌ Your competitors are huge enterprises (cluster is inaccessible)

❌ You need fast results (this is methodical and slow)

Strategy #2: Comparative Content Hijacking

This is our fastest-ROI SaaS link building strategy for companies that already have some traction.

What It Is

Find articles comparing your competitors — where you’re either not mentioned or mentioned but not linked — and get yourself properly featured.

These articles already rank.

They’re already getting traffic.

You’re inserting yourself into an existing traffic stream.

Why This Works

Someone searching “Asana vs Monday.com” is in active buying mode.

If you can get into that article with a link, you’re capturing high-intent buyers at the exact moment they’re deciding.

From our campaigns:

Comparison content links convert at 2.4× the rate of general links

Average time to first signup: 18 days (vs. 45 days)

They rank for competitor brand terms (stealing traffic)

How We Execute This

Step 1: Find Comparison Content (Days 1–2)

Google searches:

“[Competitor A] vs [Competitor B]”

“[Competitor A] alternative”

“Best [competitor] alternatives”

“[your category] like [competitor]”

“[competitor] competitors”

Use Ahrefs Content Explorer to find:

Articles mentioning 2+ competitors

Published in the last 24 months

Getting 500+ organic visits per month

Typically find 60–100 comparison articles per category.

Step 2: Audit Current Coverage (Days 3–4)

For each article, check:

Are you mentioned at all? (easier pitch)

Are you mentioned but not linked? (very easy pitch)

Are competitors linked but you’re not? (medium difficulty)

Create three lists:

Not mentioned: 40–50 articles

Mentioned, not linked: 15–25 articles

Need better placement: 5–10 articles

Step 3: Create Your Comparison Asset (Week 1)

Before outreach, create one comprehensive comparison page:

“[Your Tool] vs [Top 3 Competitors]”

Side-by-side feature table

Honest pros and cons for each tool

Use cases where each tool wins

Pricing comparison

Biased pages get rejected ~80% of the time.

Honest pages get accepted ~35% of the time.

Strategy #3: Data-Driven PR & HARO

This gets you the highest-authority links the fastest in SaaS link building. — but only if you have something genuinely newsworthy.

What It Is

Digital PR means getting featured in publications journalists actually read (Forbes, Entrepreneur, industry trades).

HARO (Help A Reporter Out) connects you with journalists looking for expert sources.

Why This Works

High-authority publications (DR 70–90) pass massive trust signals to Google.

One link from Forbes carries more weight than 15 links from random blogs.

Plus, these placements build brand credibility beyond just SEO value.

How We Execute This

The Data Angle (Most Important)

Journalists need data for stories. If you have original data, they want to quote you.

What counts as “data”:

Survey results from your users

Analysis of trends in your product usage

Industry benchmarks you’ve tracked

Comparative analysis of publicly available data

Example:

We had a CRM client survey 800 users about sales productivity habits.

A key insight:

“73% of sales reps spend 4+ hours per week on admin tasks.”

That single data point became a story picked up by:

Sales Hacker (DR 64)

Entrepreneur (DR 92)

Inc.com (DR 95)

8 industry-specific sales blogs

Total: 11 backlinks from one data study.

HARO Process (Daily Commitment)

Sign up: https://www.helpareporter.com

Every morning, you receive 3 emails with journalist queries like:

“Looking for SaaS founders to comment on remote work trends”

“Need data on B2B software buying behavior”

“Seeking expert on project management tools”

Our process:

Review queries every morning (≈20 minutes)

Respond to 3–5 relevant queries

Provide specific, data-backed insights

Include your title and company

Performance benchmarks:

Acceptance rate: ~12%

40 responses/month → 4–5 placements

Average DR of placements: 68

This is one of the highest-ROI link-building activities.

Real Example

Client: Project management SaaS

HARO commitment:

30 minutes every morning, 5 days per week

Over 90 days:

Queries responded to: 127

Placements secured: 18

Average DR: 71

Top placements:

Forbes — remote team productivity (DR 95)

Entrepreneur — startup project management (DR 92)

Fast Company — async collaboration (DR 94)

Traffic & ROI:

340 visitors in first 90 days

12 converted to trials

Direct ROI: 12 × $89/month = $1,068 MRR

Time investment:

60 hours over 90 days

That’s $1,068 in monthly recurring revenue — plus permanent DR 95 backlinks.

When This Works Best

✅ You have interesting data or insights

✅ Your founder/team can provide expert commentary

✅ You can commit 30 minutes per day

✅ You’re comfortable with public visibility

When This Doesn’t Work

❌ You have nothing newsworthy to share

❌ You can’t commit to a daily routine

❌ You’re uncomfortable being quoted publicly

Strategy #4: Resource Page & Directory Placements

This is our foundational SaaS link building strategy — especially for early-stage companies with limited brand recognition.

What It Is

Resource pages list useful tools or resources in a specific category.

Examples:

“Best Project Management Tools”

“Marketing Resources for Startups”

“Developer Tools Directory”

Getting listed is often straightforward if your tool is genuinely good.

Why This Works

These pages already have authority and rankings.

Being added gives you:

Instant visibility

Foundational backlinks

Credibility with higher-tier sites later

Acceptance rate: 10–15% (higher than most strategies)

How We Execute This

Step 1: Find Resource Pages (Days 1–2)

Google search operators:

“[your category] + resources”

“[your category] + tools”

“Best [your category] tools”

“[your use case] + directory”

“Awesome [your category]” (GitHub lists)

Also check:

AlternativeTo.net categories

Product Hunt collections

Subreddit sidebars

Industry association directories

Typical volume: 150–200 resource pages per category.

Step 2: Qualify Targets (Days 3–4)

Filter for pages that meet all of the following:

✅ Updated within last 12 months

✅ DR 20+ minimum

✅ 10+ tools listed

✅ Non-spammy, high-quality tools

This reduces the list to 80–120 quality targets.

Step 3: Personalized Outreach (Weeks 1–4)

Email template:

Subject: [Your Tool] for your [category] resources page

Hi [Name],

I came across your [page title] resource page while researching

[category] tools — really helpful collection, especially

[specific tool you genuinely like].

We recently launched [Your Tool], which [specific value proposition].

It’s currently used by [X companies/users] for [specific use case].

Would it make sense to include it on your resources page?

Here’s what makes it different:

[Unique feature 1]

[Unique feature 2]

[Specific benefit]

Happy to provide screenshots or additional info if useful.

Thanks for considering,

[Your Name]

P.S. — Here’s a direct link if you want to try it: [link]

Key elements:

Genuine, specific compliment

Social proof

Clear differentiation

Low-effort ask

Response rate: 12–18%

Step 4: Follow-Up (Week 5)

About 50% of replies come from follow-ups.

Wait 7 days, then send:

Subject: Re: [Your Tool] for your [category] resources page

Hi [Name],

Just wanted to follow up — I know you’re probably busy.

Would [Your Tool] be a good fit for your resources page?

If not, no worries at all. Either way, thanks for curating such a helpful list.

[Your Name]

Short, polite, and low pressure.

Additional response rate: 5–8%

Real Example

Client: Brand-new scheduling SaaS

Starting DR: 11 (zero backlinks)

Campaign stats:

Pages identified: 164

After filtering: 89

Emails sent: 89

Responses: 14 (16%)

Placements: 11 (12%)

Average DR: 31

Timeline: 4 weeks

Results after 60 days:

DR: 11 → 19

First page 1 rankings for long-tail keywords

Traffic: 85/month → 280/month

First organic signups: 3

These links created the authority needed to pursue higher-tier placements later.

When This Works Best

✅ You’re early-stage (DR under 25)

✅ You have a legitimately good product

✅ You need foundational links

✅ Limited budget (time > money)

When This Doesn’t Work

❌ You’re already established (DR 40+)

❌ Your product isn’t competitive yet

❌ You’re impatient (this is volume work)

Strategy #5: Integration & Partnership Links

This strategy is criminally underused by SaaS companies — yet it’s one of the most sustainable.

What It Is

If your SaaS integrates with other tools (Slack, Zapier, HubSpot, etc.), those platforms often have:

Integration directories

Partner pages

App marketplaces

API documentation pages

Getting listed in these places earns you high-authority, highly relevant backlinks.

Why This Works

These aren’t traditional “link-building” opportunities — they’re partnership placements. In SaaS link building, these partnership-based links are among the most defensible you can earn.

That means:

Higher acceptance rates (you’re a real integration partner)

Better link quality (DR 60–90 platforms)

Permanent links (rarely removed)

Relevant traffic (users actively looking for integrations)

Google also treats integration directory links as strong relevance signals.

How We Execute This

Step 1: Audit Your Integrations (Day 1)

List every tool you integrate with:

Direct API integrations

Zapier connections

Webhook compatibility

Data import/export support

Even basic integrations count.

Step 2: Find Their Directory Pages (Days 2–3)

Most SaaS platforms have:

Official app marketplaces (Slack App Directory, HubSpot Marketplace)

Integration partner pages

API documentation examples

Blog posts about integrations

Search Google:

site:[platform].com integrationssite:[platform].com partnerssite:[platform].com app directory

Step 3: Submit to Official Directories (Weeks 1–2)

Platforms like Slack, Zapier, and HubSpot have formal submission processes.

Usually requires:

App listing form

Logo and screenshots

Integration description

Link to your integration documentation

Approval timeline: 1–4 weeks

Once approved, these become permanent DR 80–90 backlinks.

Step 4: Outreach to Partner Marketing (Weeks 2–4)

Many companies maintain integration partner pages but don’t actively promote them.

Outreach email template:

Subject: [Your Tool] integration with [Their Platform]

Hi [Partner Team],

We’ve built an integration between [Your Tool] and [Their Platform] that’s currently used by [X users/companies].

The integration [specific value it provides].

Would you be open to:

Featuring it in your integrations directory?

Mentioning it in your blog or newsletter?

Including it in your integration documentation?

Happy to provide case studies, a joint webinar, or other co-marketing if useful.

[Your Name]

Response rate: 25–40%

(Much higher than cold outreach because there’s mutual benefit.)

Step 5: Create Co-Marketing Opportunities (Ongoing)

Once integration links are live, deepen the partnership:

Joint webinar → linked recording

Co-authored blog post → mutual backlinks

Shared case study → double authority

Integration tutorial → linked from both documentation sites

These generate natural link velocity without looking like link building.

Real Example

Client: Marketing automation SaaS

Integrations:

Slack, HubSpot, Salesforce, Zapier, Google Sheets

Campaign placements:

Slack App Directory (DR 93)

HubSpot Marketplace (DR 92)

Zapier App Directory (DR 93)

Salesforce AppExchange (DR 92)

8 integration-focused blog mentions

Totals:

Links acquired: 12

Average DR: 89

Timeline: 8 weeks

Results:

DR increase: 34 → 48

Page 1 rankings for “marketing automation integrations” keywords

Referral traffic: 180/month

Integration-driven signups: 47

The best part: These links don’t disappear.

As long as the integration exists, the backlinks remain.

When This Works Best

✅ You have real integrations with popular platforms

✅ You’re willing to invest in partnerships

✅ You want permanent, high-authority links

✅ You have bandwidth for co-marketing

When This Doesn’t Work

❌ You don’t integrate with other tools

❌ Your integrations are with low-visibility platforms

❌ You can’t dedicate time to partnership development

How to Choose the Right Strategy for Your Stage

Not every strategy works at every stage. Here’s how to decide.

If You’re Pre-Revenue or Just Launched (DR 0–15)

Your situation:

Zero brand recognition

No existing backlinks

Need foundation before pursuing premium links

Limited time and resources

Start with:

Resource Pages (70% of effort)

Fastest acceptance rate

Builds DR from 0 to 20–25

Low barrier to entry

Integration Links (20% of effort)

If you have any integrations, get these first

High-authority links while you’re still unknown

Comparison Content (10% of effort)

Start getting mentioned in articles

May not get links yet, but builds awareness

Skip for now:

❌ Digital PR / HARO (journalists won’t care about unknown brands)

❌ Authority Cluster (too time-intensive at this stage)

Timeline:

2–3 months to build a solid foundation

If You’re Early Revenue Stage ($10K–$100K MRR, DR 15–35)

Your situation:

Some traction and social proof

Basic backlink profile exists

Need to start competing seriously

Budget for sustained effort

Focus on:

Authority Cluster (40% of effort)

You now have enough credibility to approach cluster sites

Biggest ranking impact at this stage

Comparison Content (30% of effort)

You can show real usage data

Higher acceptance rate than pre-revenue stage

HARO / Digital PR (20% of effort)

Start earning higher-authority links

Tier-2 publications are realistic

Resource Pages (10% of effort)

Continue building foundation, but don’t overinvest

Timeline:

6–9 months to see significant movement

If You’re Growth Stage ($100K–$1M+ MRR, DR 35–50)

Your situation:

Established product with real traction

Competing directly with major players

Resources for a comprehensive strategy

Need defensible competitive moats

Go all-in on:

Authority Cluster (50% of effort)

Secure every major cluster placement

This becomes your competitive moat

Digital PR / HARO (30% of effort)

Tier-1 publications now become accessible

Focus on brand authority, not just rankings

Integration Links (15% of effort)

Deepen partnerships for permanent high-DR links

Comparison Content (5% of effort)

Mostly defensive (protect against competitor mentions)

Timeline:

12+ months — this becomes ongoing

Quick Decision Framework

Answer these questions:

What’s your current DR?

Under 15 → Start with resource pages

What Actually Moves Rankings: The Factors That Matter

After tracking 100+ campaigns, here’s what actually impacts rankings in SaaS link building.

Factor #1: Topical Relevance (40% of Impact)

This is the biggest factor — and the one most founders underestimate.

A link from a site Google sees as authoritative in your specific niche carries exponentially more weight than a random high-DR link.

From our data:

10 highly relevant links (DR 30–40)

outperform

30 irrelevant links (DR 50–60)

How Google determines relevance:

The site’s overall topic focus

Content on the specific page linking to you

Anchor text and surrounding context

Whether other sites in your niche link to this site

Example:

Link from Capterra (software reviews, SaaS-focused)

→ Massive relevance signal for SaaSLink from a general tech news site (AI, gadgets, everything)

→ Weak relevance for specific SaaS categories

Factor #2: Link Placement Context (25% of Impact)

Where the link appears on the page matters enormously.

High-value placements:

Within the main content body

Surrounded by relevant category text

In comparison or recommendation sections

Part of a curated list

Low-value placements:

Sidebar “related links”

Footer directories

Comments sections

Sponsored blocks

2023 test results:

15 links in main content body (avg DR 35)

15 links in sidebars/footers (avg DR 42)

After 90 days:

Content-body links: +11 positions average

Sidebar/footer links: +3 positions average

Lower-DR content links outperformed higher-DR sidebar links by 3.6×.

Context beats raw authority.

Factor #3: Anchor Text Distribution (20% of Impact)

This is where most SaaS companies either over-optimize or under-optimize.

Safe anchor text distribution:

35–45% branded

(“YourCompany”, “YourCompany.com”)25–30% generic

(“click here”, “this tool”, “learn more”)20–25% topical

(“project management software”, “CRM tool”)8–12% naked URLs

5–8% exact match

Dangerous distributions:

Over 15% exact match = manipulation signal

Under 30% branded = unnatural

100% exact-match variations = guaranteed penalty

Real example:

A client came to us after rankings collapsed.

Anchor audit:

62% exact match

8% branded

30% generic

Classic over-optimization.

We spent 6 months building branded and generic anchors.

Rankings recovered after 8 months.

Anchor abuse is the #1 penalty trigger we see.

Factor #4: Link Velocity (10% of Impact)

This isn’t about volume. It’s about patterns.

Natural link growth:

Gradual increase over time

Uneven month-to-month growth

Spikes tied to real events (PR, launches, viral content)

Unnatural link growth:

50 links in week one, then nothing

Perfect consistency (exact same number weekly)

Large spikes with no explanation

Rule of thumb:

Safe velocity = historical monthly rate × 2–3×

If you get 5 links/month:

Move to 10–15/month

Then 20–30

Then 40

Google understands historical patterns.

Factor #5: Link Source Diversity (5% of Impact)

Don’t get all your links from one source type.

Healthy link profile includes:

Review platforms (Capterra, G2)

Industry blogs

Business publications

Resource pages

Integration partnerships

Comparison articles

Data citations

Unhealthy profiles:

80% guest posts

Same 3 domains repeatedly

Same timeframe acquisition

Similar anchor patterns

Our targeting rules:

No source type over 40%

No single domain over 5%

Mixed DR levels

This structure has consistently avoided penalties across all campaigns.

Timeline Expectations: When You’ll Actually See Results

This is where most founders get frustrated and quit prematurely.

Let me show you what actually happens month by month.

Month 1: The Setup Phase

What’s happening:

Identifying authority cluster

Building target lists

Creating link-worthy assets

First outreach going out

What you’ll see:

Maybe 2–5 links go live (quick wins like directories)

No ranking changes yet

No traffic changes yet

This is normal. Anyone promising results in 30 days is lying or using black-hat tactics.

Month 2: Links Start Landing

What’s happening:

First wave of outreach responses

Links getting published

Google crawling and indexing new links

Follow-up outreach to non-responders

What you’ll see:

10–20 links live

First small ranking movements (1–3 positions on some keywords)

Traffic might tick up 10–20%

Zero meaningful business impact yet

Still too early. This is still foundation building.

Month 3: Initial Momentum

What’s happening:

Links from months 1–2 fully indexed

Google recalculating your authority

More links going live from ongoing outreach

You’re at 25–40 total new links now

What you’ll see:

Ranking movements becoming visible (3–8 positions)

Some long-tail keywords hitting page 1

Traffic up 30–60%

Maybe 1–2 organic signups

This is when clients start believing it’s working.

But the real gains come next.

Months 4–6: Compound Effects Kick In

What’s happening:

You have 40–80 new quality links

Authority clusters starting to recognize you

Rankings stabilizing at new levels

Some natural links starting to happen (people find and link to you)

What you’ll see:

Major keywords moving 8–15 positions

Multiple page 1 rankings

Traffic up 80–150%

10–25 organic signups per month

Lower CAC for paid channels (brand recognition helping)

This is the inflection point.

From our campaigns: Month 4–6 is when skeptical clients become advocates.

Months 7–12: Full Impact Realized

What’s happening:

You’re established in authority clusters

Natural backlinks accelerating (your authority makes you linkable)

Competitor keywords starting to rank

Brand searches increasing

What you’ll see:

Primary keywords on page 1

Traffic up 200–400%

40–80+ organic signups per month

Organic channel becoming #1 or #2 lead source

Sales team mentioning “everyone has heard of us now”

This is where link building goes from expense to asset.

The Critical Truth

Most benefits happen after month 6.

Clients who quit at month 3 waste their investment because they never reach the compounding phase.

From our data:

Clients who stay 12+ months: 91% say it was worth it

Clients who quit before month 6: 68% regret quitting

The math is clear: commit to 6+ months or don’t start.

What If You’re Not Seeing Results?

By month 6, you should see some improvement. If you see literally zero movement:

Possible issues:

Technical SEO problems (site speed, indexing, mobile issues)

Poor product-market fit (traffic won’t fix conversion problems)

Wrong strategy for your stage

Low-quality links (check if they’re from real sites)

Over-optimization penalties

Don’t panic at month 3.

Do investigate at month 6 if there’s truly zero progress.

COMMON MISTAKES THAT KILL SAAS LINK BUILDING CAMPAIGNS

We’ve seen these mistakes kill campaigns. Here’s how to avoid them.

Mistake #1: Chasing DR Numbers Instead of Relevance

The mistake:

Founder sees “We can get you DR 70 links!” and gets excited.

Those DR 70 links are from:

General tech news sites (not SaaS-focused)

Random blog networks

Sites with zero traffic in your category

Result:

Links don’t move rankings. Money wasted.

What we learned:

A DR 32 link from a SaaS review platform beats a DR 70 link from a general tech news site every single time.

Google cares about topical relevance more than raw authority scores.

How to avoid:

Before pursuing any link, ask:

“Does this site’s audience use tools like mine?”

“Would my target customer actually read this site?”

“Does Google see this site as an authority in my category?”

If the answer is no to any of these, pass — regardless of DR.

From our campaigns:

Relevant DR 30–40 links: Average 12 visitors/month, 2.8% conversion

Irrelevant DR 60+ links: Average 4 visitors/month, 0.3% conversion

Quality beats vanity metrics.

Mistake #2: No Link-Worthy Asset = Campaign Fails

The mistake:

Founder: “Just get links to our homepage.”

We outreach to 200 sites asking them to link to a basic product page.

Response rate: 2–3%

Why it failed:

Nobody links to a homepage unless you’re already famous. They link to something useful:

Comprehensive guides

Free tools

Original research

Detailed comparisons

Frameworks or methodologies

Without these, outreach doesn’t work.

What we learned:

Campaigns with strong link-worthy assets: 15–18% acceptance rate

Campaigns without: 3–5% acceptance rate

That’s a 4–5× difference.

How to avoid:

Before spending a dollar on link building, create at least one of the following:

3,000+ word comprehensive guide

Free tool or calculator related to your product

Detailed comparison page (you vs competitors)

Original research or data study

Budget $500–2,000 for quality asset creation.

This isn’t optional. It’s the foundation everything else builds on.

Mistake #3: Unnatural Link Velocity = Algorithmic Penalty

The mistake:

Client wants results fast: “Can we get all 40 links in 2 weeks?”

We get 40 links in 2 weeks.

Google sees a site that historically got 3–5 links/month suddenly get 40 in 2 weeks.

Result:

Algorithm flags manipulation. Rankings drop.

What we learned:

Natural growth is gradual. Spikes trigger red flags.

Safe velocity by current authority:

DR 0–20: Max 5–10 new links/month

DR 20–40: Max 15–25 new links/month

DR 40–60: Max 30–50 new links/month

DR 60+: Max 50–80 new links/month

Exceed these by 2× and you risk penalties.

How to avoid:

Spread acquisition over time:

Week 1–2: 8–10 links

Week 3–4: 10–12 links

Week 5–6: 12–15 links

Week 7–8: 10–12 links

This mimics natural growth.

From our campaigns:

We’ve never had a penalty following velocity guidelines.

We’ve recovered three clients from penalties caused by ignoring them — recovery took 6–12 months.

Don’t risk it.

Mistake #4: Over-Optimized Anchor Text = Penalty Magnet

The mistake:

Founder wants all links to use: “best project management software”

After 30 exact-match links, rankings tank.

Google sees manipulation.

What we learned:

Natural link profiles use varied anchors.

People naturally link with:

Brand names

Generic phrases

Topic terms

Rarely exact-match keywords

Safe distribution:

35–45% branded

25–30% generic

20–25% topical

8–12% naked URLs

5–8% exact match

How to avoid:

Track every anchor in a spreadsheet.

If someone offers an exact-match anchor and you’re already at 8%, ask for branded instead.

Most sites are happy to accommodate.

We’ve never had a penalty using this distribution across 100+ campaigns.

Mistake #5: Ignoring Competitor Gap Analysis

The mistake:

Building links without checking where competitors already have them.

Result: 40 good links — but missing the 12 sites every competitor shares.

What we learned:

Every category has table-stakes sites.

How to avoid:

Before starting any campaign:

Export top 3 competitors’ backlinks in Ahrefs

Find domains linking to 2+ competitors

These are Priority A targets

If you don’t have them, you’re at a structural disadvantage.

This is now our first step, not an afterthought.

Mistake #6: Quitting Before Month 6

The mistake:

Founder cancels after 90 days.

Rankings were up 4–6 positions. Traffic up 45%. But expectations were page 1.

They quit right before compounding kicked in.

What we learned:

Link building works like compound interest:

Months 1–3: Principal investment

Months 4–6: Interest starts

Months 7–12: Exponential growth

From our data:

12+ month clients: 320% average traffic increase

Quit at month 3–4: 45% increase, then plateau

How to avoid:

Set expectations clearly:

Months 1–3: Foundation

Months 4–6: Initial returns

Months 7–12: Exponential growth

If you can’t commit 6 months, don’t start.

We now require 6-month minimum engagements.

Mistake #7: Wrong Agency = Wasted Investment

The mistake:

Hiring a cheap agency promising “50 DR 50+ links for $1,500.”

Links come from blog networks. AI content. Zero traffic.

Google penalizes the site.

Recovery: 14 months.

What we learned:

Cheap link building is expensive.

Red flags:

🚩 Guaranteed rankings

🚩 Prices too good to be true

🚩 Won’t show sites beforehand

🚩 “Proprietary network”

🚩 Links live in 48 hours

🚩 No content creation required

How to avoid:

Ask:

“Can I see 10 specific sites you’ll target?”

“What’s your outreach process?”

“How long does placement take?”

“Can I talk to a current client?”

If they’re vague, walk away.

Quality agencies are transparent because they’re not hiding anything.

FAQ: WHAT SAAS FOUNDERS ACTUALLY ASK US

These are the questions we get on every SaaS link building sales call.

Q: How many backlinks does a SaaS need to rank?

Real answer: It depends on competition, but here’s what we’ve seen.

Low competition keywords (KD 0–25):

20–35 quality backlinks typically get you to page 1

Timeline: 4–6 months

Medium competition (KD 25–45):

50–80 quality backlinks for page 1

Timeline: 6–9 months

High competition (KD 45–65):

100–150+ quality backlinks for page 1

Timeline: 12–18 months

This assumes:

Links are relevant (not random high-DR sites)

Good on-page SEO

Decent user experience

Competitive product

But “ranking” isn’t binary. You’ll start ranking for long-tail keywords way before you rank for head terms.

Most SaaS companies see meaningful traffic with 40–60 quality links.

Q: Should I build links in-house or hire an agency?

Honest assessment:

Build in-house if:

✅ You have 10–15 hours per week to dedicate

✅ You enjoy outreach and relationship building

✅ You have 6+ months to learn and optimize

✅ Your time is worth less than $75/hour

Hire an agency if:

✅ Your time is worth $100+/hour

✅ You want results in 90 days, not 12 months

✅ You’ve tried DIY and hit a wall

✅ You want expertise without the learning curve

From our experience:

DIY results: 15–25 links in 90 days (with learning curve)

Agency results: 35–50 links in 90 days (immediate expertise)

The question isn’t capability — it’s opportunity cost.

Can you build links yourself? Absolutely.

Should you if your time is worth $150/hour? Probably not.

Q: What’s a realistic budget for SaaS link building?

Based on what actually works:

Early-stage SaaS (DR under 20):

Realistic investment: $2,000–3,500/month

Expected results: 20–30 links/month

Focus: Resource pages, broken links, early cluster placements

Growth-stage SaaS (DR 20–45):

Realistic investment: $4,000–7,000/month

Expected results: 35–50 links/month

Focus: Authority cluster, PR, comparative content

Established SaaS (DR 45+):

Realistic investment: $8,000–15,000/month

Expected results: 30–45 premium links/month

Focus: Tier-1 publications, major PR, brand authority

This includes:

Strategy and competitive analysis

Link prospecting and outreach

Content/asset creation support

Campaign management

Monthly reporting

Anyone promising significantly cheaper is either cutting corners or operating unsustainably.

Anyone charging significantly more should justify it with exceptional results or tier-1 placements.

Q: How long until I see ROI?

From tracking our campaigns:

Traffic impact: 3–6 months to see meaningful increase

Ranking impact: 4–8 months for competitive keywords

Lead generation: 4–7 months to see consistent organic leads

Revenue impact: 6–11 months to break even

The exact timeline depends on:

Your starting authority (higher DR = faster results)

Competition level (easier keywords move faster)

Quality of links (relevant links work faster)

Your product’s conversion rate

If you need ROI in 90 days, link building isn’t the right channel.

If you’re playing the 12–24 month game, link building delivers the best long-term ROI of any channel.

Q: Can link building hurt my rankings?

Yes — if done wrong.

What causes penalties:

Buying links from PBN networks

Unnatural anchor text distribution (too many exact-match)

Unnatural link velocity (50 links in 1 week)

Links from spam sites

Automated link schemes

What doesn’t cause penalties:

Quality links from real sites

Natural anchor text distribution

Gradual link velocity

Manual, relationship-based outreach

Relevant, topical links

From our campaigns:

We’ve never had a penalty when following best practices:

Relevant links only

Natural anchor distribution

Safe velocity

Manual outreach (no automation)

The risk is manageable if you do it right.

The risk is high if you cut corners.

Q: Should I disavow competitor links or negative SEO?

Real answer: Probably not.

Google’s algorithm is sophisticated enough to ignore spam links automatically.

Disavow only if:

You’ve received a manual penalty notification from Google

You have hundreds of obviously spam links

You hired a bad agency that built PBN links

Don’t disavow just because:

Competitor sites link to you (this is normal)

You have some low-quality links (every site does)

Ahrefs shows some spam score (not always accurate)

From our experience:

We’ve disavowed links for maybe 5% of clients.

The other 95% don’t need it. Google handles spam automatically.

Unnecessary disavows can actually hurt you by removing good links.

When in doubt, don’t disavow.

Q: What’s the difference between white-hat and black-hat link building?

Simple distinction:

White-hat (what we do):

Manual outreach to real people

Building genuine relationships

Creating valuable content worth linking to

Earning links through merit

Sustainable long-term

Black-hat (what to avoid):

Buying links from PBN networks

Automated link generation

Comment spam and forum spam

Manipulative anchor text

Short-term gains, long-term penalties

Grey-hat (questionable but not clearly penalized):

Guest posting on low-quality sites

Reciprocal link exchanges

Link insertions on old content

We stay strictly white-hat because:

It’s sustainable (won’t get penalized)

It builds real authority (not just rankings)

It compounds over time (doesn’t plateau)

Black-hat might work for 6–12 months, then you lose everything.

White-hat works slower — but lasts forever.

HOW TO VET A LINK BUILDING AGENCY (IF YOU’RE HIRING)

Most SaaS founders don’t know how to evaluate agencies. Here’s exactly what to ask.

Question 1: “Can you show me 10 specific sites you’ve gotten links from in the past 30 days?”

Good answer:

Shows actual domains (real recent examples)

Explains why those sites matter

Domains are relevant, real sites with traffic

Bad answer:

“We can’t share client specifics” (red flag)

Shows random high-DR sites with no relevance

Vague or evasive

Tip: If they can’t show recent real examples, walk away.

Question 2: “What’s your outreach process?”

Good answer:

Explains manual research and personalization

Talks about relationship building

Mentions response rates (typically 10–20%)

Acknowledges it takes time

Bad answer:

“We have a proprietary network” (= PBN)

Mentions automation tools heavily

Promises immediate placements

Won’t explain the actual process

Tip: Real outreach is manual and relationship-based. If they’re vague about process, they’re hiding black-hat methods.

Question 3: “What’s the timeline to see ranking improvements?”

Good answer:

60–90 days for initial movements

6–9 months for significant improvements

Explains it’s gradual and compounds

Sets realistic expectations

Bad answer:

“30 days to page 1” (impossible)

Guarantees specific rankings

Promises immediate results

Doesn’t mention the gradual nature

Tip: Anyone promising fast results is lying or using risky tactics.

Question 4: “Can I talk to 2–3 current clients?”

Good answer:

Provides references willingly

Connects you with similar-stage SaaS companies

References confirm what agency promised

Bad answer:

Refuses or hesitates

Only provides testimonials (not actual calls)

References are vague or can’t verify results

Tip: Real agencies have happy clients willing to vouch for them.

Question 5: “What happens if we don’t see results in 6 months?”

Good answer:

Explains diagnostic process

Mentions possible technical issues to check

Has a plan B if strategy isn’t working

Reasonable performance guarantees (not ranking guarantees)

Bad answer:

“That won’t happen” (overconfident)

No contingency plan

Locks you into 12-month contract with no outs

Blames you if it doesn’t work

Tip: Good agencies know not every campaign works perfectly and have plans to adjust.

Red Flags to Watch For

🚩 Won’t show you target sites before you pay

🚩 Guarantees specific rankings

🚩 Prices that seem too good (DR 50+ links for $20)

🚩 Requires 12-month contract upfront

🚩 Can’t explain their process clearly

🚩 No SaaS-specific experience

🚩 All reviews are generic 5-stars (fake)

Tip: If you see ANY of these, keep looking.

Green Flags to Look For

✅ Shows specific domains and recent placements

✅ Transparent about realistic timelines

✅ Has documented SaaS case studies

✅ Provides references you can actually call

✅ Explains their process clearly

✅ Admits what they DON’T do

✅ Has been around 3+ years

Tip: A good agency is transparent because they’re not hiding anything.

CONCLUSION

Here’s what I know after 5 years and 100+ campaigns:

SaaS link building works. But only if you:

✅ Focus on topical relevance over vanity DR metrics

✅ Target your authority cluster systematically

✅ Build link-worthy assets first (don’t skip this)

✅ Maintain natural anchor text and velocity

✅ Have patience for the 6–12 month timeline

✅ Avoid shortcuts and black-hat tactics

The SaaS companies winning at organic search aren’t the ones with the most links.

They’re the ones with the most strategic links from the right places.

We’ve seen bootstrapped companies with 60 targeted links outrank funded competitors with 300 random links.

Strategy beats volume. Always.

If you’re just starting out:

Create one exceptional link-worthy asset (guide, tool, or comparison page)

Map your authority cluster (30–50 key sites)

Start with resource pages and directories (build foundation)

Be patient through the first 90 days (this is normal)

Scale what works after you see initial traction

If link building isn’t working:

Audit existing backlinks (are they actually relevant?)

Check anchor text distribution (is it natural?)

Review competitor gaps (are you missing key cluster sites?)

Verify link velocity (did you go too fast?)

Check technical SEO (is something blocking results?)

How Outreach Empress can help you?

We work with SaaS companies at every stage—from pre-revenue to $10M+ ARR.

Our approach:

Authority cluster-focused (not random high-DR chasing)

White-hat only (sustainable long-term)

Transparent process (you see everything we do)

Realistic timelines (6+ months for real results)

Want us to analyze your backlink profile and show you the fastest path to page 1?

No sales pitch. We’ll show you:

Your current position vs. competitors

Exact authority cluster gaps

Realistic timeline and strategy

Whether we’re even the right fit

About half the companies we audit, we tell them “you’re not ready yet” or “you’d be better off with X approach first.”

We only work with companies where we’re confident we can deliver results.

If that’s you, let’s talk.

Either way, I hope this guide saves you from the expensive mistakes we’ve seen (and made) over the past 5 years.

SaaS link building isn’t magic. It’s strategic, patient, relationship-based work.

But when done right? It’s the most compounding marketing investment a SaaS can make.SaaS link building